DW: Is the US currency a risk for Europe? Euro against dollar at highest level since 2021

The US dollar continues to lose value against other major currencies, following the trend of 2025. Last year, the US currency recorded its strongest loss in almost a decade. The minus against a group of other currencies in 2025 amounted to about 10 percent. Since the beginning of 2026, the decline has been another minus 2.6 percent.

The dollar's decline has had repercussions for the euro and other currencies. The single European currency has reached $1.20 for the first time since 2021. The British pound and the Japanese yen have also risen against the dollar to record levels. Some economists and analysts attribute the dollar's continued decline to a lack of investor confidence in the US currency, as the unpredictability of President Donald Trump's policies continues to cause concern.

There is another perspective, according to which Trump himself and many members of his economic team want a loss in the value of the dollar, in the hope that exports from the US will be at more favorable prices and thus increase competitiveness.

Trump has not attempted to refute this speculation. On the contrary, when asked this week if he was worried about the weak dollar, he replied: “No, it’s very good.” Stephen Miran, former chairman of Trump’s economic advisory board and now a member of the Federal Reserve Board, published a “Guide to Restructuring the Global Trading System” in November 2024. Tariffs and dollar depreciation were presented as important instruments to reduce the US trade deficit.

Why does this affect Europe?

The weakening dollar is not only affecting the US economy, but also has consequences for the eurozone economy and the euro. The common currency gained 13 percent against the dollar in 2025 - the strongest increase since 2017. The strengthening euro plays "an important role for economic performance, the labor market and the financial position of budgets" in the EU, says Jack Allen-Reynolds, deputy chief economist for the eurozone at Capital Economics. "A stronger euro reduces the competitiveness of exports, which hurts producers in the region," Allen-Reynolds tells DW. "On the other hand, imports are cheaper, which leads to lower prices for consumers."

Ricardo Amaro, chief eurozone economist at Oxford Economics, warns that a further appreciation of the euro against the dollar could increasingly affect the competitiveness of European companies that export to the US. This is indeed offset by the favorable price of US products in Europe, according to Amaro. But overall, the current exchange rate, if it remains the same, would have a negative effect on economic growth in Europe.

"According to our calculations, the eurozone's gross domestic product this year would be around 0.2 percent lower if the euro-dollar exchange rate remains at the current level (1.20 USD), instead of the 1.16 USD rate that served as the reference point in the EU-US trade agreement at the end of July," Amaro tells DW.

The euro’s rise against the dollar has fueled speculation about whether the European Central Bank will need to intervene. Martin Kocher, governor of the Austrian Central Bank, sees the euro’s current rise as “moderate.” If the euro’s value continues to rise, the ECB will have to intervene. The ECB is already trying to influence market expectations, with senior ECB officials saying they are “monitoring the situation and expressing reservations about recent developments,” says Ricardo Amaro. “This raises the question of cutting interest rates to curb the euro’s rise.”

Jack Allen-Reynolds also believes that there is no need to intervene at the current level of exchange rate fluctuations. But he believes that further changes could prompt the ECB to lower interest rates later this year. Meanwhile, Zsolt Darvas argues that the current inflationary consequences are almost zero and no sector is particularly sensitive. "Exchange rates have fluctuated strongly in recent decades. Businesses are prepared to cope with even stronger fluctuations than what we are currently seeing," Darvas estimates./DW

Happening now...

ideas

Hasimja kërkon të

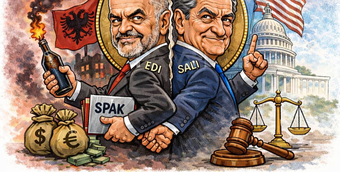

For the reform parties, the government and the opposition

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128