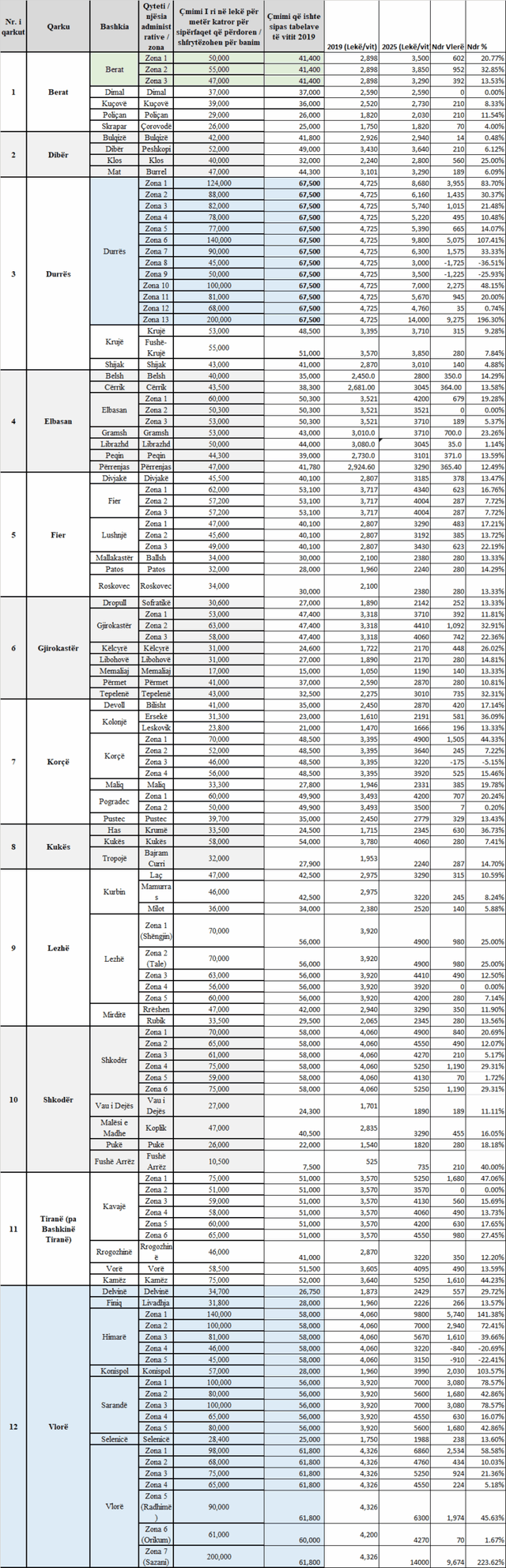

Table/How much will the building tax obligations for owners of parking lots and basements in the districts increase?

The increase in reference prices in the districts, in addition to the building tax obligations of families and businesses, is expected to also lead to an increase in tax obligations for owners of closed parking lots and basements.

In the taxation of buildings, the methodology approved in 2018 by the government, where the value of the building is calculated based on the reference prices of apartments, also included garages and closed basements for taxation.

Referring to the methodology for calculating the building tax, the tax rate for garages and basements at the national level is 0.2% of the value of the real estate being taxed.

While the price per square meter of construction area for covered parking and basements is 70% of the price of residential apartment areas according to cities. So the value of a closed garage or basement is calculated at 70% of the price of the reference price of residential apartments according to the cadastral areas of cities.

Monitor has calculated the new building tax liability of an owner of a closed garage or basement with an area of 50 m2 for 119 new cadastral zones in districts. Currently, districts are divided into only 1 cadastral zone for each city. With the new prices, the addition of several new zones is proposed. The new reference prices in districts proposed by the Ministry of Finance are expected to begin implementation from January 1, 2026.

The increase in obligations for owners of garages and basements in the districts is expected to range from 0.2% to 196%, at the same values that the new reference prices in the districts are also expected to change.

Specifically, according to the calculations, the owners of garages and basements in cadastral zone no. 13 in Durrës, which on the ground coincides with the area near the port, will be charged with more obligations. In this area, the reference prices of apartments from 67,500 lek per square meter are proposed to be 200,000 lek per square meter. An increase of 196%.

If an individual owns a closed garage with an area of 50 m2 in this area, from the 4,725 lek per year building tax liability that they pay, after the approval of the new reference prices they will be charged with a liability of 14,000 lek per year. The increase in value will be 9,275 lek more than they currently pay or 196.3% more.

A high increase in obligations in Durrës is also expected for cadastral zone no. 6, which coincides with the coast of the Bay of Lalëz. From the 4,725 lek per year that an individual currently pays for the garage tax, with the entry into force of the reference prices, the obligation will increase to the value of 5,075 lek. The new obligation for an owner with a closed garage with an area of 50 m2 will be 9,800 lek per year or 107% more than they currently pay.

Significant increases in building tax obligations for garages are also expected for the new cadastral zones in Himara. Specifically, in cadastral zone no. 1, the reference price increases from 58,000 lek per square meter, which is currently proposed, to 140,000 lek per square meter.

The building tax liability for the closed garage will increase from the current 4,060 lek per year to 9,800 lek per year. The increase in value is estimated at 5,740 lek per year or 141.3% more.

Meanwhile, in cadastral zone no. 2 in Himara, the tax liability for a garage or basement owner is expected to increase from 4,060 lek per year to 7,000 lek per year. An increase of 2,940 lek or 72% more.

The increase in building tax obligations for residential apartments, commercial units, basements and closed garages also occurred in Tirana, following the decision adopted at the end of July 2023, to increase the reference prices on which the value of real estate for building tax is calculated. The reference prices had remained unchanged since 2016.

With the changes that came into effect in July 2023, prices increased in the 32 cadastral zones of the capital and in the 5 administrative units of Tirana. While in that period, reference prices in the districts remained unchanged.

In Tirana, apartment reference prices increased from 5 to 76%.

The area with the highest reference prices continues to be the former Block, which corresponds to cadastral area 5/1. With the 2016 reference prices, the fiscal price of this area was 190,000 lek per square meter. With the latest changes, the price reaches 228,400 (an increase of 38,400 per square meter or 20%).

There was also a high increase in cadastral areas 8/2 (Madrasa, Pharmacy no. 10, Industrial Market). The reference price value increased by 56,700 lek/m2. In cadastral area 10/1 (PTT, Telecom, former Writers' League) the price increased by 47,800 lek per square meter./ D.Azo

The Ukraine summit that ignored the tough questions

ideas

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128